As utilities face increasingly challenging market conditions, electric vehicles (EVs) may present utilities with some interesting opportunities. Challenges ahead for utilities are expected to strain their financial health, which will likely result in retail rate increases. And that’s where EVs might offer revenue growth that could help offset revenue loss from current energy efficiency trends and rising costs from expansive infrastructure replacement and upgrade investments.

As utilities face increasingly challenging market conditions, electric vehicles (EVs) may present utilities with some interesting opportunities. Challenges ahead for utilities are expected to strain their financial health, which will likely result in retail rate increases. And that’s where EVs might offer revenue growth that could help offset revenue loss from current energy efficiency trends and rising costs from expansive infrastructure replacement and upgrade investments.

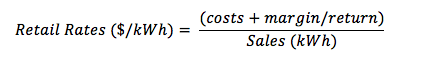

In simplified form, retail electricity rates for investor-owned and municipal utilities are determined by adding all costs to a regulated margin or return on rate base and dividing by the amount of electricity sold:

Current momentum is eroding the denominator of this equation (lowering sales volume) and, as the economy struggles, utility customers implement distributed generation (DG), and/or they invest in energy efficiency improvements. Simultaneously, many utilities are facing increased costs to upgrade aging infrastructure and comply with existing or emerging requirements imposed by the EPA, NERC and local governments. And therein lies the problem. If utilities cannot grow sales or reduce costs to compensate for these market changes, they have no option but to raise retail rates for customers.

Ironically, plug-in electric vehicles (EV) represent sales growth potential and are struggling to gain traction in the auto industry and with consumers across the country. If realized, most utilities are concerned with the negative impact a large-scale adoption of EVs might have on their systems, but few, it seems, are embracing their revenue potential.

It’s true that if a majority of EV owners plug their vehicles in at or around the same time to charge, peak load impacts on utilities’ infrastructure could be significant, especially if this mass plug-in occurs between 5-6 p.m. on a hot summer day when electrical grids are already strained due to AC load. This peak load increase could cause complications to grid operations and would likely require upgrades to generation and distribution assets. In fact, in France where adoption of EVs has already gained traction, French utilities are facing similar challenges. However, if proactively managed by utilities, the EV peak load crisis may be mitigated, which would allow utilities to embrace the increased sales associated with mass EV adoption without significant costs required to accommodate them.

Revenue Potential from EVs

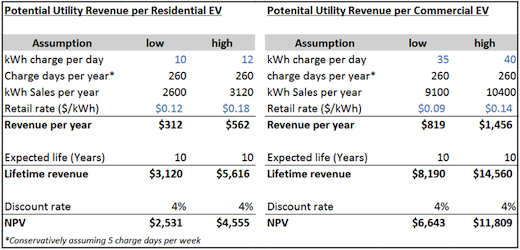

Currently, the national average retail energy rates are 9 cents and 12 cents per kilowatt-hour for commercial and residential customers, respectively. However, in many coastal and metropolitan areas, retail rates may exceed 20 cents per kilowatt-hour. Using conservative assumptions, a residential EV owner could represent $300 to $560 in additional revenue per year, depending on the local retail energy rate. Similarly, a commercial EV (delivery truck or equivalent), with larger battery capacity and more consistent daily charge requirements could represent $800 to $1,450 in additional revenue per year, depending on the local retail energy rate. Assuming that, on average, an EV owner will remain an EV owner for at least 10 years, each residential and commercial EV should be worth, at a minimum, somewhere in the neighborhood of $2,500 and $6,600, respectively, over the lifetime of the ownership of the EV.

Utilities Well-Positioned to Facilitate EV Adoption

The two primary concerns consumers and business owners have with purchasing an EV are acquisition costs (EVs are more expensive than traditional gasoline or diesel-fueled equivalents) and range anxiety, which may limit EV operation due to concerns about limited access to charging stations. Range anxiety will always be a problem until battery technologies evolve significantly or transportation requirements change. That said, existing technologies are well suited for many short-range commuters and delivery functions. Cost issues, however, are where utilities have an opportunity to exert influence. Just as the mobile telephone carriers subsidize expensive handsets in exchange for guaranteed monthly revenue streams, utilities could subsidize expensive EV acquisition costs, thereby removing a barrier to purchase and easing the adoption process for consumers. One cost in particular that utilities would be well-positioned to offset would be the purchase and installation of EV chargers in customers’ homes and businesses.

Benefits of Utility-Led Installation of EV Chargers

There are myriad benefits to utilities in the installation of EV chargers in consumers’ homes and businesses. Utilities are already a part of consumers’ lives, and they possess the skilled personnel and customer relationships to effectively and safely manage the installation of EV chargers on their system. In addition to facilitating increased revenue, managing the installation of EV chargers provides utilities with additional benefits, which include:

- Ensure safe and consistent installations that adhere to local and federal building codes

- EV charger hardware discounts through mass buying and vendor relationship management

- Potential to influence charging times through opt-out timers built into chargers

Mitigate Peak Load Impact of EVs

The third benefit listed above may be the most important benefit of all: influencing charging times to limit use during peak hours. As mentioned earlier, the greatest fear of most utility system operators and leaders is that as EV adoption grows, every EV owner will come home from work and plug in their car, smack dab in the middle of the summer late afternoon system peak period, increasing total system peak demand and driving investment in upgraded distribution assets or new generation capacity. But if utilities provided EV charger installation for free or at a significantly reduced price, they could easily justify the inclusion of system peak load limiting technologies as compensation for the subsidy. In fact, to start, these technologies don’t need to be more complex than a simple timer incorporated into the charger that, unless overridden, kept cars from charging during peak periods by default. Of course, regulators would likely require that this timer be easily overridden in order to protect consumer rights, but even so, a majority of EV owners will simply plug in and submit to the default timer within the charger, especially if they are educated about the reasons for it — namely to help utilities manage cost of service. They could also be personally motivated by offering lower electricity rates during non-peak hours, resulting in lower utility bills.

EVs May Be Incented Anyway

Ironically, if government leaders succeed through the Energy Security Trust, EV peak load impacts may become a reality on their own, regardless of whether or not utilities participate. Under a federally driven scenario, utilities may be at the mercy of EV load growth without leverage to influence it and mitigate peak load impacts.

As such, it behooves utilities to get involved early, explore embracing EV revenue growth, and develop pilot technologies and programs that influence when EV charging takes place. Consumers routinely look to their utility to guide them on matters of energy consumption. In the near-term, utilities may use this position to bolster their long-term financial health, enable customers to more easily adopt cars with lower lifetime cost of ownership, and reduce our country’s dependence on foreign oil.

From a long-term perspective, developing a strong relationship with EV owners now will also position utilities well in the future to pursue more advanced programs such as direct EV charge control and vehicle-to-grid (V2G) aggregate resources.

What do you think? Should utilities embrace and incentivize EV adoption? It would be great to hear your thoughts on this topic.

Lucas McIntosh is a utility consultant and project manager in Burns & McDonnell's Analysis Group. Lucas specializes in financial and engineering analyses of smart grid investment projects, including business case analysis, smart grid technology evaluations, utility programs, and rate design and evaluations. Lucas has directly supported numerous investment analyses, implementations and program designs for both municipal and investor-owned utilities.

This post originally appeared on EnergyCentral

Image: Redcorn Studios [Matt] via Compfight cc