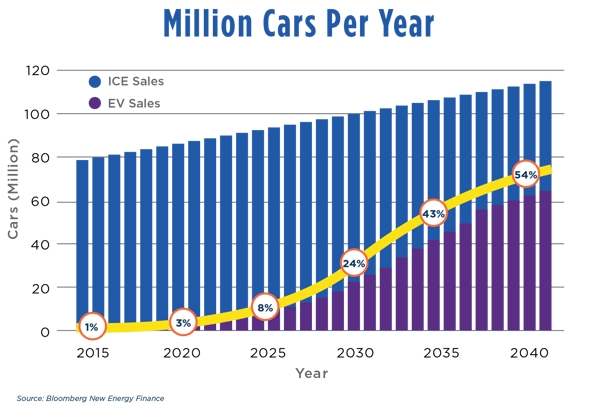

The market for electric vehicles (EVs) is beginning to mature as mobility companies continue to increase their investments in vehicle electrification. We’re seeing new models and redesigns produced, like the Tesla Model 3, Chevy Bolt, Nissan LEAF and BMW i3, and consumer demand is increasing around the nation and the globe. Many industry analysts estimate that by 2035 more than 40 percent of all new light-duty vehicle purchases will be electric. (Source: Bloomberg.com’s New Energy Finance’s 2017 Long Term Electric Vehicle Outlook)

EVs are no longer just for the wealthy or environmentally conscious. They are becoming a practical, economical and exciting option for drivers as their cost have plummeted in recent years. As of July 1, 2018, Tesla was producing 5,000 Model 3s each week as it worked to meet its backlog of over 450,000 pre-orders — all while continuing to produce its existing models, the S and X.

Other vehicle manufacturers like Volvo, Volkswagen and BMW are making large financial and strategic commitments to convert their fleets to electric in support of national and state initiatives mandating EVs or abolishing the use of petroleum-based vehicles over the next 20 years. Bloomberg’s study also forecasts that annual EV sales are expected to reach 60 million by 2035.

Most industry analysts believe this transition is expected to take place rapidly over the next several years. However, one important question remains: Are utilities and their customers ready for the new demand for power that comes with such a transition?

My Experience Owning an EV

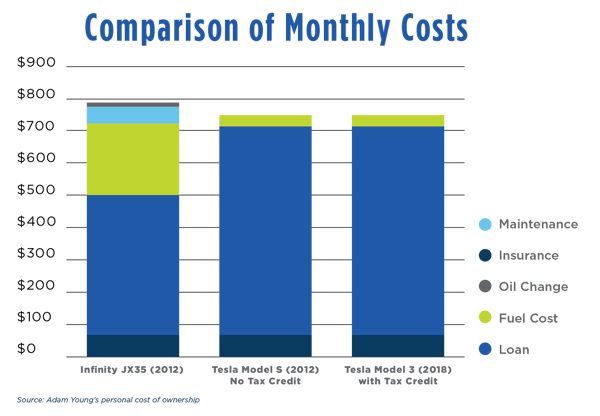

Many EV owners have begun transitioning to electric vehicles due to their faster acceleration rate, battery range exceeding 300 miles, and lower cost of total ownership. From a more personal perspective, my wife (who is also an engineer) and I recently purchased a Tesla Model S. Putting on our engineering hats, we “ran the numbers” diligently before deciding to trade in our seven-seater SUV. We found that our gasoline-driven vehicle was costing us nearly $800 per month in loan payments, gasoline, maintenance, oil changes and insurance compared to a used Tesla Model S costing less than $750 per month. After evaluating the costs and considering the large trunk and frunk (trunk space in the front of the vehicle) for storage and seating, we made the transition from gas station to garage electrical outlet. As more low-cost and long-range vehicles become available in the market, like the $35,000 base Tesla Model 3, the overall cost and performance advantage will likely continue to increase, along with customer adoption levels.

Examining Peak Usage Hours

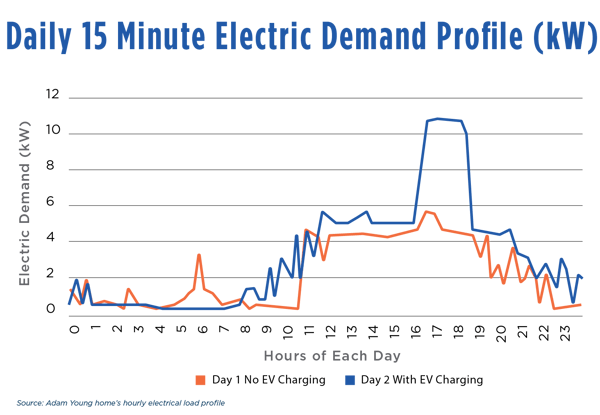

What most customers and electric utilities haven’t fully addressed — but should be looking at closely as EV growth accelerates — is the incremental local electric distribution system infrastructure and electric generation and transmission systemwide upgrades that will be required. Without hourly price signals in their electricity rates, customers will generally choose to plug in when coming home from work between the hours of 4 p.m. and 6 p.m. These hours are when demand on the electric grid is typically at its peak; this incremental vehicle charging load, when concentrated, will overload circuits and equipment in specific areas and will require utilities to make upgrades with no immediate way to pass those costs directly to the EV customer, instead bearing those costs until a future rate case where rates could be adjusted. As demonstrated by my own home’s hourly electrical load profile, when plugging in at 6 p.m. in the summer, the peak would likely increase from 5.5 kW to nearly 11 kW.

The Effect of EVs on Residential Neighborhoods

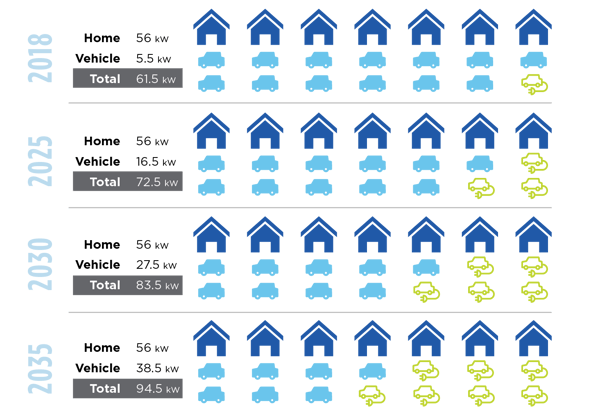

The increase in local electric demand is not a concern at current low EV adoption levels. However, as more EV owners begin charging at home, certain distribution circuits and customer transformers will experience overloads. Like rooftop solar, residential EV charging has occurred in pockets across the distribution system. Some neighborhoods and distribution circuits will have higher concentrations of EVs over time, which will result in higher peak demands if left unmanaged.

The degree of customer adoption and market penetration will initially depend on demographics that are region-specific. Over the next 15 years, nearly all areas of the United States will experience much higher levels of EV adoption. With the expectation that over 40 percent of all new vehicles will be EVs by 2035 we will begin to see circuits realizing undiversified peak load increases of up to 50 percent if unmanaged.

Other Effects of EVs

Residential neighborhoods are not the only areas that will need to be examined and considered. As businesses and other large parking structures begin to integrate EV charging equipment into their facilities, the incremental impacts will significantly increase loads in areas that never previously experienced any significant EV charging loads.

Electric bus depots, airport rental car facilities, commercial distribution facilities, ports and other vehicle fleets that either recharge over night or sporadically during the day will require significant local system upgrades to the distribution systems beyond the charging station and low-voltage upgrades.

Bus depots, for example, which can have more than 200 commuter buses on-site at any one time, have the potential to create very high concentrated electric loads. Los Angeles County's transit system, Los Angeles Metropolitan Transit Authority, plans to convert to an electric bus fleet by 2030. Each bus could use up to 130 kW of demand depending on the charger selected, yielding a potential peak load (unmanaged) of up to 26,000 kW for a single lot. The existing local distribution system is grossly undersized for this potential load and will require new substations, new distribution circuits and potentially transmission system upgrades.

Opportunities for Utilities

EV growth in the light-duty and heavy-duty areas presents an interesting opportunity and challenge for electric utilities. An average residential customer charging at home will increase the annual site peak demand by nearly 100 percent. The annual site electrical usage and revenue will rise 30 percent to 40 percent under a purely volumetric energy rate structure, which is typical of most utilities. If EV charging peak demand is not managed or controlled by the customer or utility, the utility’s costs will increase by similar levels if new generation capacity and distribution upgrades are required to serve this load.

The best way to serve these customers with the most cost-efficiency is by implementing time of use (TOU) electric rates and peak demand rates for residential customers. These TOU rates have been proven to be an effective method of shifting EV charging load to late night time periods when the electric system’s load is low. Low off-peak energy rates allow the EV customer to save money and the electric utility to use its unused capacity and low-cost off-peak energy. This has been best demonstrated by SDG&E’s 2014 Electric Vehicle Time of Use Study, which demonstrated that more than 80 percent of residential EV customers on a TOU rate will shift all of their EV charging load to low cost off-peak hours.

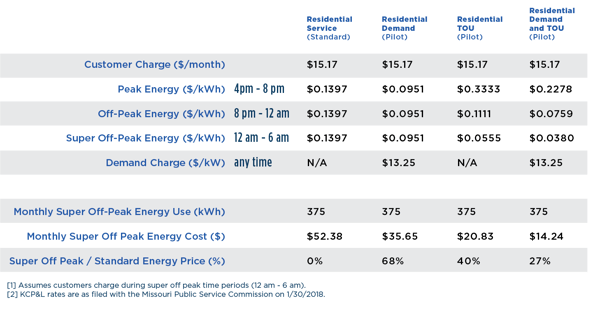

Many utilities have already begun to make significant investments in advanced metering infrastructure (AMI) and upgraded customer billing systems that will allow them to adequately serve these customers with TOU electric rates in the future. More progressive electric utilities, like Kansas City Power & Light (KCP&L), are in the process of completing strategic investments in new metering and billing systems that will allow for the implementation of new TOU energy and demand rates proposed for residential customers in both Missouri and Kansas.

The pilot TOU energy rates proposed for KCP&L will provide a strong cost-based rate that can be used by its Missouri customers to pay for lower-priced energy and allow the utility to avoid costly investments in new generation and distribution system capacity. For example, the customer choosing to use the residential demand and TOU pilot rate for charging their EV will pay nearly 75 percent less than they would under the standard residential service. This load shifting will also provide cost avoidance for the utility by moving load off the system peak to the late night, low-cost hours.

Thinking Ahead: Metering and Billing Systems

The utility that is making or that has already made the strategic investment in their metering and billing infrastructure will be able to offer TOU rates to its customers. These TOU rates will provide a cost-of-service-based rate structure, promote economic efficiency, promote peak load reduction, provide customer value and satisfaction, and support cost EV charging and other off-peak usage to existing and future EV customers. TOU rates will also enable both the customers and the utility to use the infrastructure it already owns to serve this incremental load. The utility that doesn’t prepare and plays the wait-and-see game will be inefficiently building more underutilized generation and distribution system infrastructure to serve a higher system peak load with lower system load factor.

If your utility isn’t ready for residential transportation electrification, it’s time to start preparing, studying and planning to upgrade your metering infrastructure, customer billing systems and electric rate structures. If you’re not working with your large commercial customers with fleets of vehicles, it’s time to start helping them with the transition to beneficial and cost-effective transportation electrification.

The accelerating adoption of electrification, especially in the transportation sector, brings about significant implications for power infrastructure. How will communities and consumers adapt?