Climate-related risks can have a substantial impact on utilities’ operations. Investors are eager to learn more about how those organizations are addressing the looming challenges. They also want to understand utilities’ contributions to climate shifts and are looking for reductions in carbon emissions. To support investors’ interests, the U.S. Securities and Exchange Commission (SEC) is expected to finalize and publish rule amendments in the first quarter of 2023 to expand and standardize disclosures of climate-related risks among publicly traded companies, including investor-owned utilities.

Utilities have already begun preparing for the revised rules, which will cover matters of governance, financial statement metrics, and climate-related targets, goals and transition plans. How quickly utilities will need to incorporate new reporting standards for the proposed disclosures will depend in part on the size of the utility and its registration type.

All Eyes on Timelines

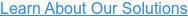

When the SEC announced the proposed disclosures, it also released schedule tables for the phase-in periods. These tables assumed the rules would be adopted effective in December 2022. The SEC announced plans in January 2023 to finalize the rule, along with a few others, during the first quarter of the year, but the following dates remain instructive in terms of relative timelines and how they could affect the preparation of annual reports.

For disclosure compliance, one date is given for Scope 1 and Scope 2 greenhouse gas emissions and associated intensity metrics; another date is provided for Scope 3.

-

- Large accelerated filers have a public float of at least $700 million and have been subject to the requirements of the Exchange Act Section 13(a) or 15(d) for a period of at least 12 calendar months. For example, Duke Energy is a large accelerated filer, but several of its subsidiaries are not.

- Accelerated filers have a public float between $75 million and $700 million; have been filing periodic reports for at least 12 months; have previously filed at least one Form 10-K report; and are not designated as smaller reporting companies.

- A smaller reporting company (SRC) cannot be an investment company, asset-backed issuer or majority-owned subsidiary of a parent company that is not an SRC itself. SRCs also either have a public float of less than $250 million, or have annual revenues of less than $100 million and a public float of less than $700 million.

- Non-accelerated filers are those that do not fit the other three categories.

- Public companies’ filing status can be found in the SEC’s EDGAR database.

Large accelerated filers can expect to start incorporating the disclosures in the reports prepared as early as this year.

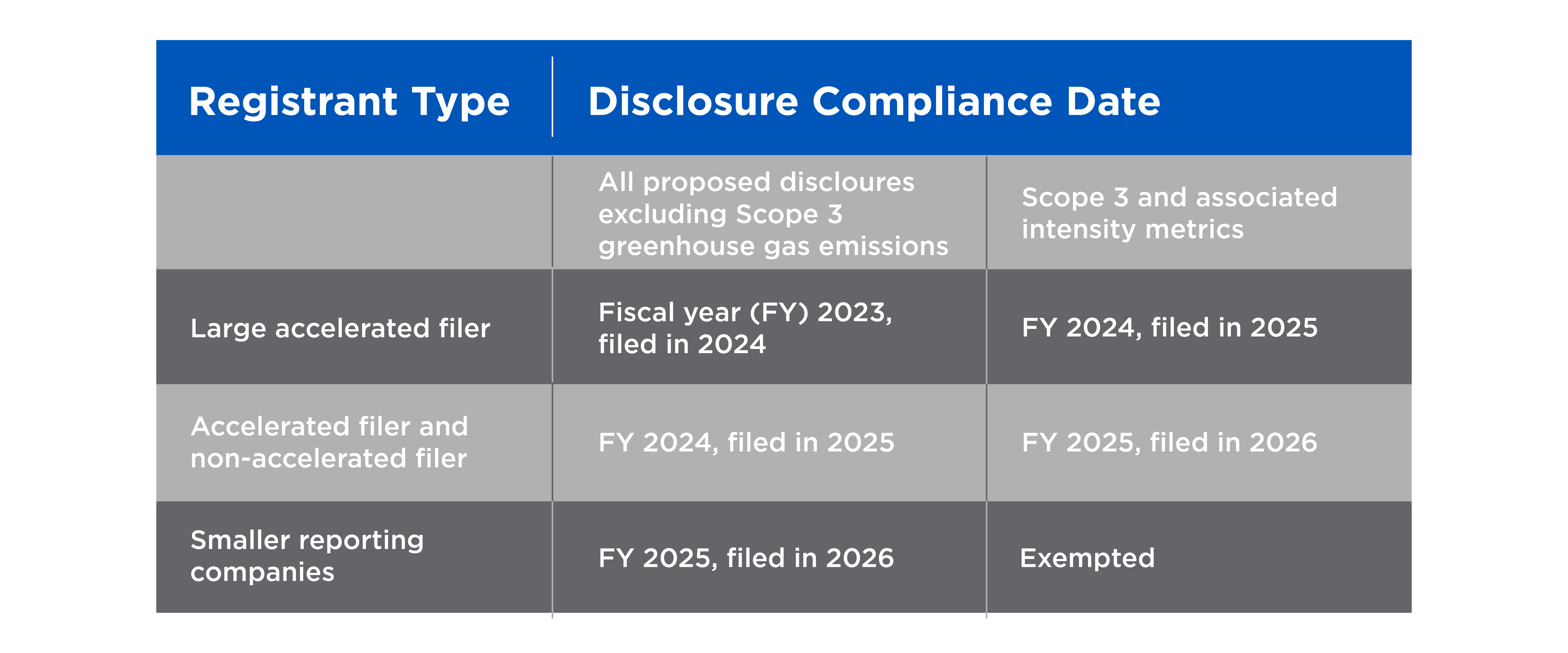

The proposal also provides a phase-in period for both the assurance requirement and the level of assurance required for accelerated and large accelerated filers. It would not require assurance in the first year of disclosure compliance, but it would become effective during the second year for these types of filers.

-

- Assurance is a measure of the level of confidence that outside parties can have about the outcome of evaluations or measurements. Reasonable assurance indicates that a third party has comprehensively checked all figures and calculations; limited assurance is based on a smaller, representative sampling.

The SEC has not explicitly spelled out penalties for failure to comply with the revised rules, but there are precedents pertaining to misstatements and omissions that might provide a frame of reference. For some utilities, the direct financial impacts of failure to comply adequately could be secondary to the reputational risk that could result from negative news coverage, including potential effects on share price, earnings and brand degradation.

Much Ado About Something

Reliability and resiliency are essential to how utilities provide power. Customers sometimes treat the electricity in their homes like football fans treat linemen: They may offer little praise for good performance, but they may become upset when performance is noticeably poor. The increasing intensity and frequency of extreme weather events threatens utility service reliability.

Consider two recent examples. Winter Storm Uri resulted in widespread blackouts across Texas in February 2021. The financial repercussions may well last decades as ratepayers cope with an estimated $50 billion in utility bills after prices spiked to encourage more production during and immediately after the storm. AccuWeather estimated economic losses from service outages and equipment damages to be $130 billion in Texas. More recently, Hurricane Ian cut a vicious path across Florida in September 2022, temporarily knocking out power to millions of electricity customers.

Both storms caused significant disruptions to utility operations and subsequently to the households and businesses they serve. Recovering the costs will take years. The disruptions might have been worse if not for investments that utilities had already made — and customers still are paying for — in hardening system infrastructure, the network and equipment to bolster resiliency.

The impacts of heat waves and record droughts also seriously threaten a vital resource within the overall process involved in many energy generation systems: water. The availability of water is a critical concern because about 86% of U.S. electricity production — including some fossil fuel generation, nuclear power and hydropower — depends on fresh water as a cooling mechanism or for steam to spin a turbine.

A Lighter Footprint

The public has a strong interest in how climate-related risks will affect utility operations. Utilities of all sizes are already hard at work preparing plans, investing in improvements, and maintaining grid reliability for an energy-hungry society. The imminent rule amendments from the SEC should help utilities by standardizing the information they collect and share with all interested parties.

Utilities’ successful compliance with the disclosure rules will depend to a degree on the resources and personnel they are able to allocate to the task. The new disclosure requirements will require collection of detailed information and projections based on factual data and scientific analysis. Many may turn to engineering and environmental consultants, like Burns & McDonnell, to help aggregate the data, as many already do for ESG (environmental, social and governance) data reporting, as utilities work to put a strong foot forward.

Sustainable operations require future-focused solutions. We help you understand and evaluate industry challenges to act on your sustainability initiatives.