Harnessing solar power can be an immensely effective way to mitigate rising electricity costs for commercial and industrial businesses. Whether you’re looking to mitigate rising electricity costs, curb operating costs or achieve corporate-level sustainability goals, investing in solar may be the right solution.

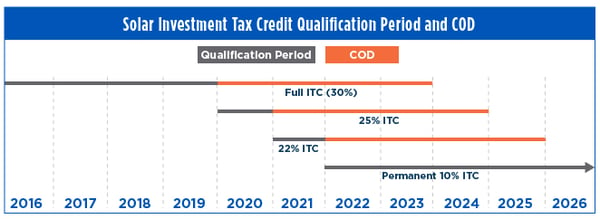

As the initial investment in solar projects was daunting in the infancy of the solar market, the federal Investment Tax Credit (ITC) was enacted to accelerate solar deployment through improving a project’s ROI. The ITC has been effective in helping to spur solar development. In fact, according to the Solar Energy Industries Association, the industry has seen a 59 percent compound annual solar growth since the ITC was enacted in 2006. However, the full percentage credit availability potential will be ending with the conclusion of 2019. Though time is dwindling, there’s still time to secure the full credit if you act now.

Understand the ITC Schedule

The ITC will not completely evaporate after 2019; however, the percentage will decrease year-over-year until it permanently levels out in 2021. Therefore, the same projects that start construction in 2020 will receive a 26 percent credit versus the full 30 percent by starting now.

Take Advantage Before Time Ticks Down

If you’re interested in pursuing a solar project, such as installing solar panels on a facility for your commercial or industrial company, the full credit is attainable by meeting two points: spending 5 percent of the project costs in 2019 and completing the project within four years. Now, what qualifies for the 5 percent spend should ultimately be determined in consultation with your tax professional.

While the determining factors of a qualifying 5 percent spend can be fluid, the four-year project completion timeline is set in stone. In fact, the deadline is so important that the IRS has stated that any qualified solar project extending past the four-year mark will need to show proof of continuous construction to receive the credit. So, jump-starting a solar project in 2019 could be possible, but requires a thoughtful plan.

Overall, if a solar project is in your company’s future, the time to act is now before this generous 30 percent tax credit slips away. With a detailed discussion with your tax professional and an engineering firm specializing in solar design and engineer-procure-construct (EPC) project delivery, you could end up with more money in your pocket while pursuing this renewable energy.

See how industries are harnessing the power of renewable energy.